An Interview with Christina Hobbs, CEO of Verve Super

At present, women in Australia retire with approximately half the superannuation (super) balance of men. According to recent data, men aged 60 – 64 retire with an average superannuation balance of $270 710, whilst women in the same age bracket retire with a mere $157 050 in superannuation. Woefully, the retirement income gap for indigenous Australians is shameful: the superannuation balance of Indigenous men and non-Indigenous women is close to identical, however, Indigenous women retire with far less than either.

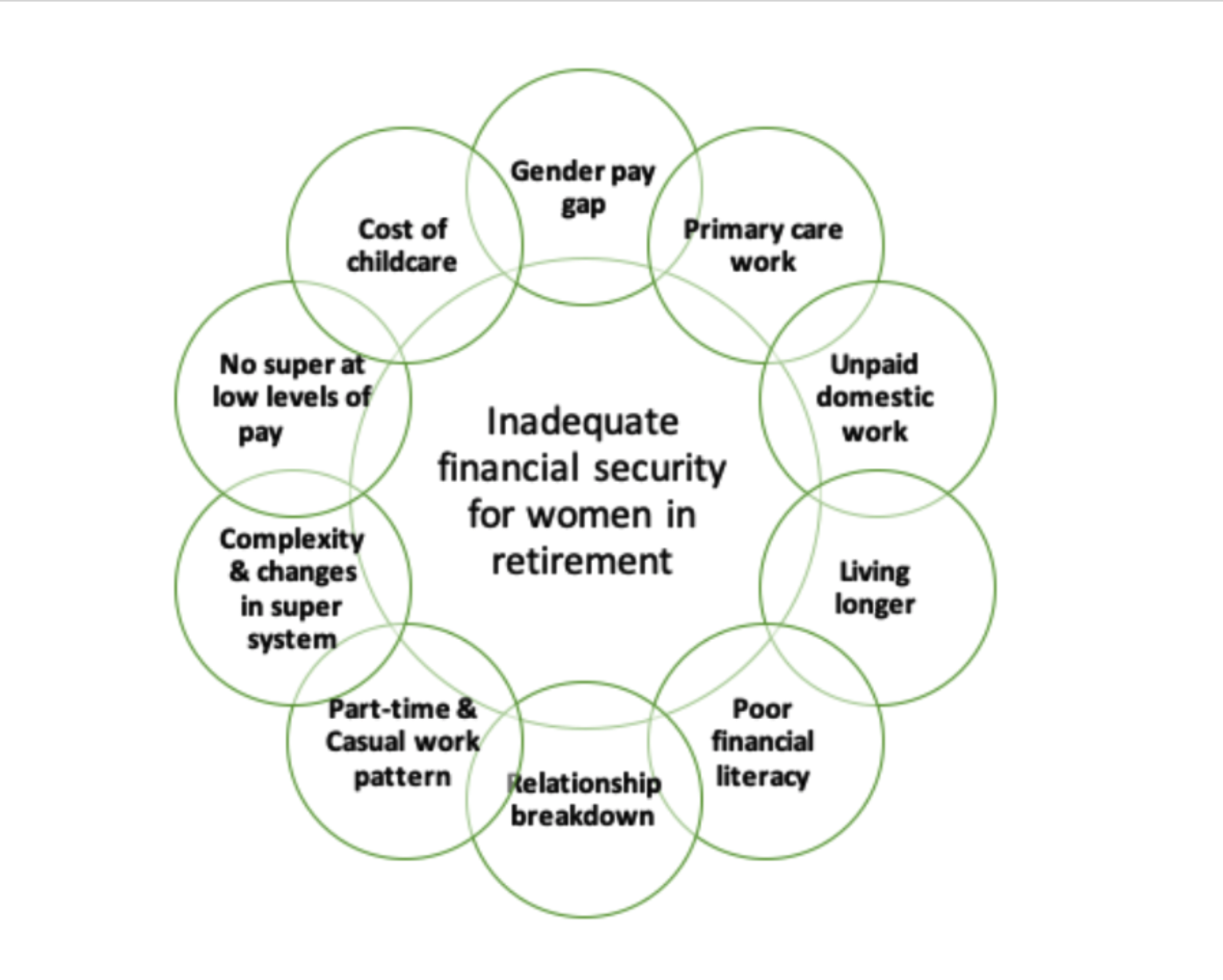

There are several key interrelated factors hindering the ability of women to accumulate equal – or even comparable – superannuation balances as men. These include:

The gender pay gap;

Interrupted career trajectories;

Family and care commitments;

Gender-segregation in the labour market; and

Societal and cultural factors.

In sum, a confluence of variables and distinct circumstances experienced by primary care-givers and women, embedded within a structure of traditional gender-roles mean that retirement income through superannuation is a wicked problem. COTA Australia saliently emphasises that, “the wheels of retirement income security are set in motion many decades before most people even begin to think about how well they are placed to manage financially in later life.”[1]

The multifaceted sources which contribute towards female financial insecurity in retirement [2]

Verve Super aims to tackle this superannuation gap. In a financial services landscape dominated by men, Verve super is a superannuation company designed by women, for women. Founded by Christina Hobbs, Zoe Lamont, and Alex Andrews, the fund launched at the end of 2018 with goal of assisting women build their financial power. CEO of the fund, Christina Hobbs, kindly agreed to answer our questions about women, the superannuation gap, and the importance of a diverse and ethical investment portfolio.

Can you give us a bit of background on Verve Super starting with your ethos, and how the company came to be?

We are Australia’s first superannuation fund for women, by women. The purpose of Verve Super is to help close the 47 per cent super gap between men and women, and support women to invest in a better world.

Before founding Verve, I was working for the United Nations (UN) in Iraq. I originally started my career with the UN as an economist. And because I was living in conflict affected countries seeing the terrible impacts on people every day, I started researching more about weapon companies and their lobbying influences on governments around the world.

One day I discovered that my own superannuation was actually being invested in companies that were creating some awful weapons, this included rifles that had been used in US shootings, as well as weapons that had been used in conflicts! I was not alone, most Australians have their money invested in weapon companies, tobacco, gambling and fossil fuel companies without our knowledge. I could not believe it, because as an economist I know that there is so much research available to show that investing ethically is more profitable in the long run. Investing ethically is a win-win way of using our wealth to build a better world.

I soon joined forces with Zoe and Alex. Zoe Lamont had spent over a decade as the CEO and founder of a not-for-profit financial coaching organisation, and had coached over 10 000 women. Alex Andrews had worked in the superannuation financial services industry and was passionate about supporting women better.

We surveyed hundreds of women to understand how we could support them manage their money and their super better. Then, together we founded Verve – to support women build wealth and use their super to invest in a better world.

Why is it important for women — particularly young women — to care about superannuation?

Many women receive their first superannuation account from their employer and never think much about it – over time many women keep accumulating new funds and end up with many accounts. This is a real worry because for many of us superannuation will be one of the biggest assets we own when we retire, so we need to make good decisions about it.

Our superannuation is also a huge investment in the future we want to be living in – do we really want our money invested in companies that are harming our communities and polluting our planet? Or do we want to invest in ethical companies that are building a better world (like healthcare, technology and agriculture).

Taking control of your super doesn’t need to take that much time, and small simple actions when you’re younger can lead to significant increases in wealth when you’re older. As an example, we’ve made it super simple for women to join us and, in the process, we find existing super accounts, so our members can easily bring them together. This is a really great outcome for our members, because most of them have had more than three accounts and we know that having more than one account can cost people tens of thousands of dollars by the time they retire.

It is undeniable that a gender gap in superannuation exists – what are some ways women can engage their super?

Firstly, it’s important to bust a myth: the gender gap in super does not exist because women are in any way bad at managing money. The opposite is actually true: the super gap exists because the overall system was never designed to support women to retire comfortably and independently.

As an example, there is no payment of super or retirement support accumulated when people are on parental leave or other types of carers leave, and, there is no compensation for the fact that women get paid less than men. As a result, men receive two thirds of the $36 billion dollars in tax concessions that is spent through the system each year.

It is because of all this that women need to pay more attention to their super, here are some quick tips:

Most women only need one super fund: make sure to join a fund like Verve Super, that will help you find all your super accounts easily so that you can consolidate in a couple of minutes.

Think about making additional contributions: you can also generally save on tax by doing this.

Have an idea about how much you may need in retirement and how you are tracking so you can work towards a goal. This will help you feel less stressed as well!

Think about where your super is invested and if your investments align to your values. Be proud of the future that your super is investing in.

How does Verve Super assist women who face less straightforward career trajectories (for instance, women who have taken time out of the workforce to raise children, or care for elderly parents)?

We assist in a couple of ways: firstly, we pause fixed fees for up to 12 months for members who are new parents on parental leave. We also offer to contact employers to ask them to keep paying super during this time. Moreover, we provide financial coaching and mentoring to support women navigate this time, and how to structure their finances. Finally, Verve advocates for fairer retirement policies for women and actively calls on the government to ensure the superannuation guarantee is paid while people are on parental or carers leave.

Women in Australia are retiring with approximately 47 per cent less in superannuation then men. However, this gap grows for Indigenous women, migrant women, and women of colour. Can you tell us more about this?

The reason the retirement savings gap is so great, and impacts women so much, is that it actually amplifies the lifetime of income inequality that different people experience. We know that women of colour, women with disabilities and migrant women are all more likely to experience greater discrimination during their lives, and this will be amplified in retirement.

We also need more research about the economic inequality facing Australians who identify as non-binary. At the end of the day, advocating for a fairer retirement system will benefit many Australians – not just women.

Your investment strategy eschews companies which exclude women from leadership. Can you please expand on this?

This is a classic example of why investing in ethical companies leads to better performance. There is so much evidence demonstrating that companies with more board diversity perform better. A company without a woman on the board has literally ignored half the talent in the world. When I see this, I think – “that’s a ridiculous decision”, and I know they are a backwards thinking company and that will be reflected throughout their business. On one hand, I morally don’t want to be investing in these companies but it is also smart investing by us.

In 2018, Boston Consulting Group reported that companies with more diverse management teams reported innovation revenue that was 19 percentage points higher than that of companies with below-average leadership diversity. Why is diversity important and how does Verve Super ensure a diverse fund portfolio?

There’s also a great stat that superannuation funds with 30 per cent of women in leadership have outperformed male-dominated funds by $7 billion dollars over the past three years!

As a super fund we have two ways we can apply pressure. The first is through ‘divesting’ – so not investing in certain companies. The second way that we can apply pressure is by investing in companies, and then as a shareholder rocking up to their Annual General Meeting (AGM) and asking questions.

It’s hard in superannuation to only invest in companies with strong diversity, because sadly there are so few companies that are truly great. We considered only investing in companies with a third of women on their board or senior Executive teams but there were too few companies which made the cut.

So instead, we created a screen where we don’t invest in companies without a woman on their board and then we rank all the companies that we do invest in, so that we can start advocating for the worst performers to do better. As a super fund we have power as a shareholder and we want to leverage that on behalf of our members!

Verve Super is also advocating for change in superannuation policy by ensuring that members (of any gender) who have recently become new parents (through birth or adoption) will not pay membership fees for 12 months. Why is this important for narrowing the gap in superannuation balances?

We do this to show solidarity with our members, because its periods of unpaid carers leave that really hit the super balances of women. It’s unfair that parents aren’t paid superannuation while they are on carers leave, as this work is so important. We strongly believe that the government should also provide additional credits to top up super balances for anyone taking time out of the workforce to care. When people contact us to tell us they are going on leave, we also offer to contact their employers and ask their employers to keep paying super.

Lastly, if you could amend one aspect or part of superannuation policy to make it more equitable what would it be, and why?

Firstly, we need a retirement equality target. Presently, we don’t even have acknowledgment that retirement inequality is an issue, let alone a plan to fix it. Women over 55 years of age are the cohort experiencing the fastest rates of homelessness in Australia, but our superannuation system is still structured assuming that behind every overworked, underpaid woman is a man who will financially support her in retirement. We need the government to acknowledge that times have changed and we need a commitment to fix the system.

If you believe in this vision, you can sign on to Verve’s MakeOurFutureFair campaign to call for this target to be set, or find out more about Verve via their website at www.vervesuper.com.au.

References:

[1] McGrath, S. (2015). Submission to the Senate Standing Committee on Economics: Inquiry into Economic Security for Women in Retirement, pg. 5

[2] This figure has been adapted from: Hetherington, D., & Smith, W. (2017). Not so Super, for Women: Superannuation and Women’s Retirement Outcomes. Retrieved from https://percapita.org.au/our_work/not-so-super-for-women/